Credit card borrowing capacity

30k in cards reduces how much you can borrow by about 150k. Its calculated based on your basic financial information such as your income and current debt.

How Much Credit Should I Have And Does It Impact My Credit Score Forbes Advisor

For the Virgin Money No Annual Fee Card 35000 pa.

. HOW CAN I KEEP MY CREDIT CARD BUT REDUCE THE LIMIT. Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property. Up Loans - Credit cards impacting.

While it is true that credit cards can help you build your credit score there are some factors about your credit card that might be your downfall when its time for you to apply. Reduce your credit limit on credit cards or close any unused credit cards. Just call your bank and advise them to do so.

So for instance if you can borrow 20000 at 20 on credit cards they are going to worry less about your getting yourself in trouble with their offering a 10000 line of credit at a much. Ever wondered why it matters what your credit card limit is if. FirstHomeBuyerFriday Are you a couple with no dependents.

Some expenses or debts can significantly reduce your borrowing capacity or even make your loan application to be declined. You can calculate your credit utilization by using the following. A credit card limit of 40000 can reduce your borrowing capacity by 160000 4 x the credit limit.

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund. The credit limits on your credit cards dont meet your current borrowing needs. Credit utilization is 30 of your credit score making it the second most important factor in determining your score.

Pre-credit crunch the amount you could borrow as a mortgage was largely defined as a multiple of your annual salary. Your borrowing capacity will be assessed every time you apply for credit so it pays to understand how your borrowing power is calculated what impacts it and how to maximise it. Did you know a 10000 credit card could reduce your borrowing capacity by as much as 50000 - even if you never use the cardIn the eyes of many banks tod.

Whats my borrowing capacity. This includes credit card debt ongoing financial. No credit check is involved nor is it a guarantee of the approved financing which you may.

So speak to your mortgage broker before applying for a loan. Permanent residents must earn at least 25000 pa. As a potential homebuyer your credit.

Credit card limits affect borrowing capacity on roughly a 15 ratio. Also cards with high limits is an easy road. Lenders will consider any credit cards to be drawn to their full limit even if you have never exceeded the allocated credit limit or found yourself behind repayments.

For example if you. If your monthly spend is 1500 then you do not need 6000. For the Virgin Money Low Rate Card and Virgin Australia Velocity Flyer Card or.

Youll hear the term borrowing capacity on home loans your car loan. Find out what your borrowing capacity could look like and how a credit card can affect this. People with exceptional credit scores 800 or higher on the FICO Score range of 300 to 850.

680 views 23 likes 5 loves 6 comments 0 shares Facebook Watch Videos from Up Loans.

What Is A Credit Utilization Rate Experian

Credit Card Capital One Citi Other Banks Cut 99 Billion From Spending Limits Bloomberg

Credit Card Interest Calculator Find Your Payoff Date Total Interest

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

Credit Card What It Is How It Works And How To Get One

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

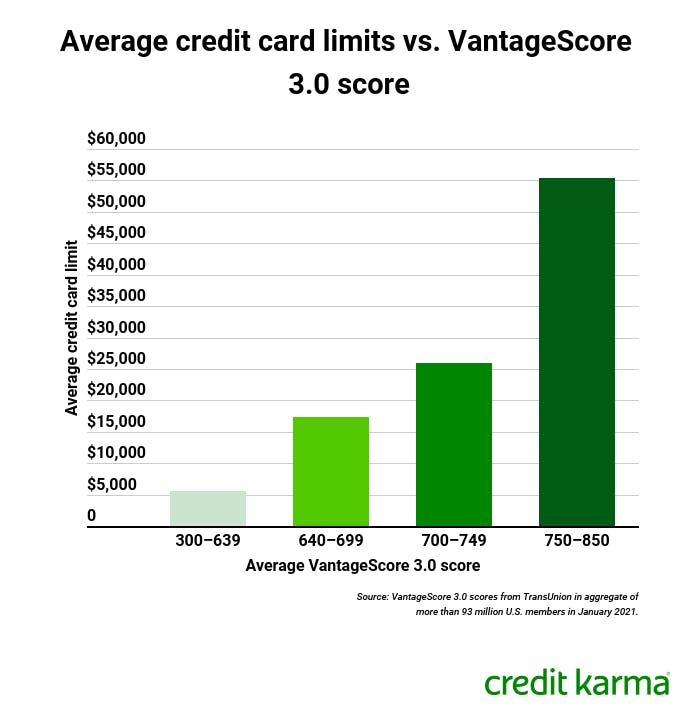

What Is A Credit Limit And How Is It Determined Credit Karma

Credit Cards Visa

Can You Transfer Credit Limits Between Credit Cards Experian

Faq Capital On Tap

Credit Card Vs Personal Loan Which One Is A Better Option Finance Buddha Blog Enlighten Your Finances

/credit-cards-Adam-Gault-OJO-ImagesGetty-Images-56a906ee3df78cf772a2f137.jpg)

Credit Card What It Is How It Works And How To Get One

Home Loans 6 Ways To Increase Your Borrowing Power The Borrowers Home Loans Best Credit Cards

How To Effectively Manage Pay Off Credit Card Debt

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Options For Dealing With Credit Card Default Finserv Markets

Credit Card Arbitrage Free Money Or Dangerous Gamble

Highest Credit Card Limits Of 2022