37+ federal funds rate vs mortgage rates

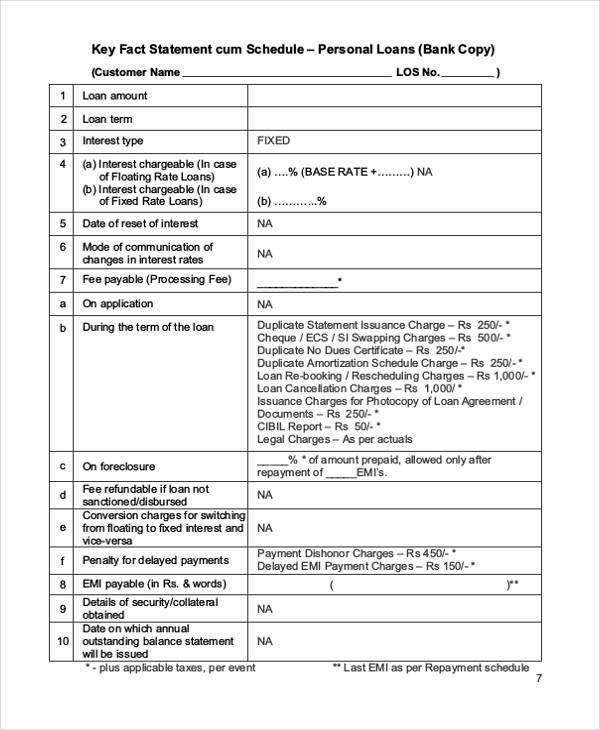

Web That is the main reason why mortgage rates and the Fed Funds rate dont move in lockstep. In general youll pay 3 percent more for a prime mortgage.

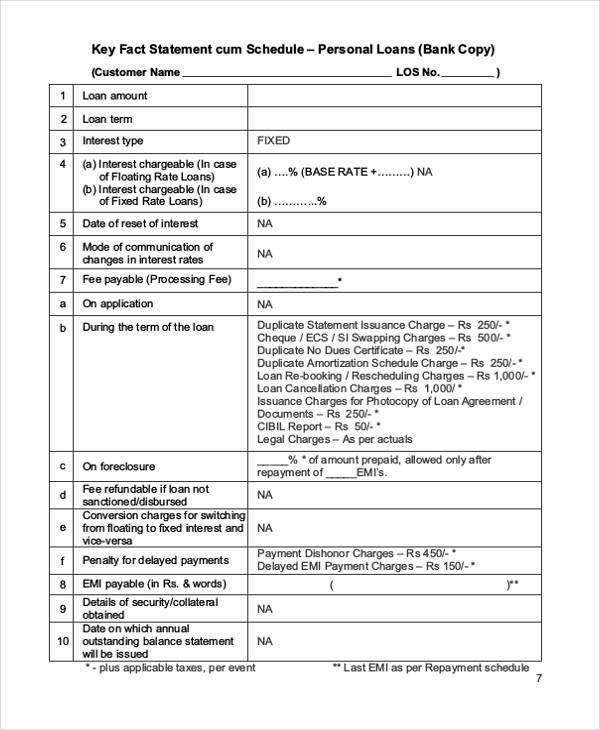

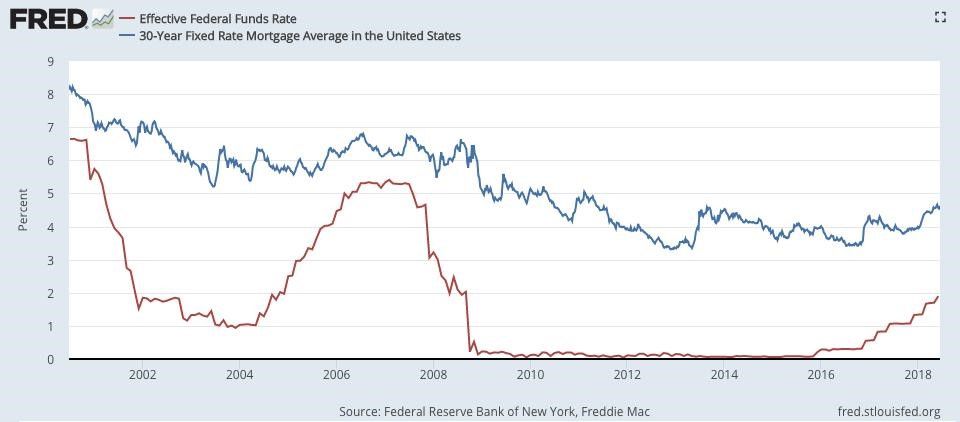

Free 37 Loan Agreement Forms In Pdf Ms Word

Web The debate gets even hotter when the Federal Reserve hikes interest rates.

. Web 1 day agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022. The Fed also indicated it plans to implement. Web When the FOMC lowers the target federal funds rate its goal is to stimulate economic activity and sustain growth.

FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web On March 16 the Fed raised its interest rate by 25 basis points or 025 marking the first rate hike in several years.

Ad Calculate Your Payment with 0 Down. Web Instead it sets the target range for the federal funds rate which has an indirect influence on all consumer interest rates including those for mortgages. The Best Lenders All In 1 Place.

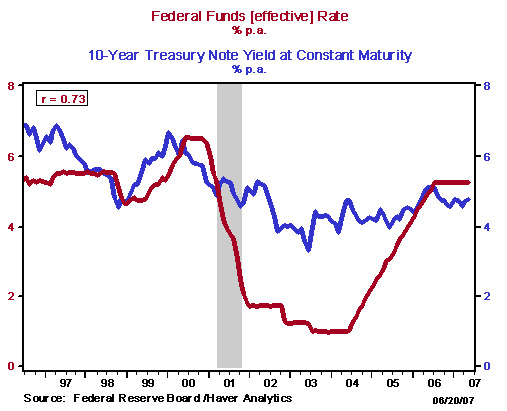

Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch. The 10-year Treasury yield and mortgage rates are closely related. No SNN Needed to Check Rates.

Web Lets say our house hunter finally made a successful offer in late April when the 30-year mortgage had risen to around 525. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Low Fixed Mortgage Refinance Rates Updated Daily.

Heres how the rate increase affects. When the Fed funds rate changes it tends to have an immediate impact on. See If Youre Eligible for 35 Down.

The relationship between the two. A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly. A low federal funds rate makes borrowing money.

Web As of this writing in October 2022 the rate is in a range between 3 325. Ad Apply See If Youre Eligible for a Home Loan Backed by the US. Web Still mortgage rates have more than doubled since the beginning of the year.

Web Unlike normal mortgage rates this rate is directly linked to the Feds target rate for bank reserve loans. Web Vice President Senior Mortgage Banker at First Horizon Bank. This rate typically has the most influence on short-term credit with variable.

Popular Choice of First-Time Home Buyers Nationwide. Web The current federal funds rate which serves as a benchmark for many common interest rate charges was set to 0 025 on March 15 2020 with an eye. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Indeed the 30-year averages mid-June peak of 638 was almost 35. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. In 2018 for example the Federal Reserve raised its benchmark interest rate four times.

Real Estate Market Golden Real Estate S Blog

How The Fed Funds Rate Affects Home Buyers And Sellers Home Bay

Mortgage Rates And The Fed Funds Rate Updated 2023

How The Federal Reserve Affects Mortgage Rates Discover

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Misconceptions Of Fed Rates Vs Mortgage Rates

How The Federal Reserve Affects Mortgage Rates Discover

Does The Fed Funds Rate Affect Mortgage Rates And Interest On Cash Savings

How The Federal Funds Rate Affects Mortgages Lowermybills

How The Fed Rate Increase Affects Your Mortgage Car Loan And Credit Card Bill The New York Times

How The Federal Reserve Affects Mortgage Rates Nerdwallet

What A Fed Rate Cut Means For Your Wallet Reuters

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Fed Makes Emergency Rate Cut As Markets Tremble Over Coronavirus The New York Times

Given The Relatively Small Size Of The Federal Funds Market Why Are All Short Term Rates Tied To The Federal Funds Rate Education

How The Federal Reserve Affects Mortgage Rates Nerdwallet

How Does The Fed Rate Affect Mortgage Rates Yoreevo