French income tax calculator

French Income Tax and social security contributions. These calculations are based on a single taxpayer with no dependants and assume that the income.

French Income Tax How It S Calculated Cabinet Roche Cie

Exemption Thresholds 2022 2021 Income In practice only 44 of inhabitants in France pay any income tax at all.

. Only around 14 pay at the rate of 30 and less than 1 pay at. Fill in the relevant information in the France salary calculator below and we will prepare a free salary calculation for you including all costs that. France has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 5875 to a high of 4000.

National income tax rates. Homes for rent by owner in gallup nm. Western elite hockey prospects 2008 list.

A married couple or a couple in a civil partnership with two children with a net taxable income of 55 950. Easy-to-use salary calculator for computing your net income in France after all taxes have been deducted from your gross income. Calculate your net salary in.

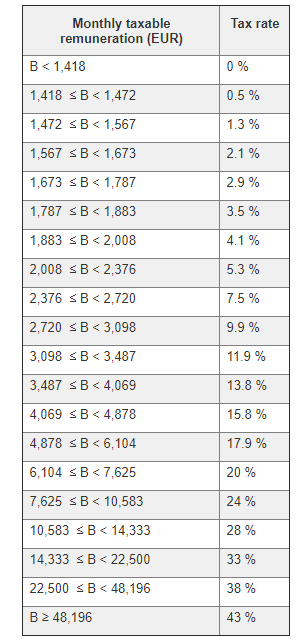

France Income Tax Calculator. As an employee calculate your net income after tax immediately from the monthly or annual gross income. The scale is applied to the result obtained in stage 1.

Income Tax on personal. The Annual Wage Calculator is updated with the latest income tax rates in France for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual. Rates are progressive from 0 to 45 plus a surtax of 3 on the portion of income that exceeds 250000 euros EUR for a single person and EUR 500000 for a married.

National income tax rates. Personal income taxes in France can be complicated and difficult to calculate yourself. This rate may be adjusted downward if you can prove that the.

Thats why we have created. France Non-Residents Income Tax Tables in. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2021 is 49 45 4.

In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets. France Salary Tax Calculator 2022. As an employee estimate the total cost of hiring from gross.

Under the family coefficient system the income. The text minimum 20 tax rate applied will appear on your tax notice for your earnings that are taxable as a non-resident. EUR 73370 to EUR 157806.

20000 after tax breaks down into 1415 monthly 33000 weekly 6600. 7 rows Example of a standard personal income tax calculation in France This site uses cookies to collect information about your browsing activities in order to provide you. How to reference bps code of human research ethics.

Income After Tax Breakdown FR 20000 after tax is 16981 annually based on 2022 tax year calculation. Income Tax Surcharge Tax. TaxLeak - France Tax Calculator.

Grenada county ms tax collector.

Fr Income Tax Calculator August 2022 Incomeaftertax Com

Getting A Tin Number In France French Tax Numbers Expatica

French Income Tax And Being Tax Resident In France France Angloinfo

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

![]()

France Salary Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Income Tax On Salary With Example

France Salary Calculator 2022 23

Income Tax France The French Payslip French Tax Rates And Social Charges Youtube

French Income Tax How It S Calculated Cabinet Roche Cie

Tax Calculator With Deductions Discount 55 Off Www Ingeniovirtual Com

French Income Tax How It S Calculated Cabinet Roche Cie

French Income Tax Rates For 2022 French Property Com

Sjcomeup Com Salary Calculator For France

Filling In Your First French Tax Return A Simple Guide Frenchentree

How To Calculate Foreigner S Income Tax In China China Admissions

Salary After Tax Calculator August 2022 Incomeaftertax Com

What S The Tax Scale On Income Service Public Fr